6 Credit Strengthening Software to aid Increase your Credit score

For most, a credit history is actually a valuable conclusion, having product reviews stretching to the payday loans in Minturn CO 700 otherwise 800 well worth variety. For most people in the event, a credit history are a variety that would be enhanced.

Some Us citizens features a credit rating lower than 700, getting increased score helps you safer finest terminology with the loans, in addition to down interest levels. Exactly what if you would like assistance with your credit rating? Reported by users, will there be an application regarding?

Thankfully, discover in fact certain applications so you can replace your credit rating. Playing with an app usually takes time for you to improve your credit score, however, a software will help you which have finding your way through a more robust economic coming.

Given that payments are available, Care about account your towards-big date repayments with the around three first credit reporting agencies (Experian, TransUnion and you will Equifax), assisting to raise your credit rating

- Experian

- Borrowing Karma

- Self

- Kikoff

- MoneyLion

- Grow Credit

Because the money are designed, Thinking reports your own to the-date money to the three number 1 credit agencies (Experian, TransUnion and you can Equifax), assisting to boost your credit history

- No-costs upgraded look at your Experian get

- Membership for real-time borrowing from the bank overseeing

- Totally free Experian Increase to boost credit rating

Experian is just one of the about three biggest credit reporting agencies that gathers and reports your financial guidance as the an excellent around three-hand amount – aka your credit score .

A credit history support other programs regulate how risky its so you can financing your money according to the borrowing from the bank and payment record.

Understanding where you’re is the best answer to start building your credit score

From the totally free Experian app, you can examine your newest Experian credit history and you will ratings of Equifax and TransUnion, which can be current yearly.

If you decide to pay for the fresh new Experian application, you might receive your latest credit history regarding the almost every other two bureaus. The fresh subscription is costly but also provides a full image of your own newest borrowing situation.

One to free function we like try Experian Boost, and therefore contributes repeating bills into the credit report to assist increase your credit score. You will want at the least around three repeating payments, such as for example power bills otherwise ongoing memberships to help you HBO Max or Netflix.

If you have ever wrestled together with your credit history, you’ve likely made use of or at least heard about Credit Karma . Which individual finance company facilitate Us americans pick its fico scores from the no cost.

Even though Borrowing Karma’s credit history revealing should be exorbitant on account of utilizing the Vantage rating system, instead of the more prevalent FICO credit score. Still, the Vantage credit score are adequate to make you a crude concept of where you are.

Another noteworthy quirk: Borrowing from the bank Karma merely reports TransUnion and Equifax results. You’ll want to on their own look at the Experian credit rating, sometimes online or perhaps in the new Experian app.

The genuine cause we like Borrowing Karma is that the application teaches you this new bad and good activities affecting your results, allowing you to pick situations to best them and change your credit history.

This service membership likewise has situated-when you look at the equipment having training playing cards and you will money you to top matches your financial situation and you will credit history.

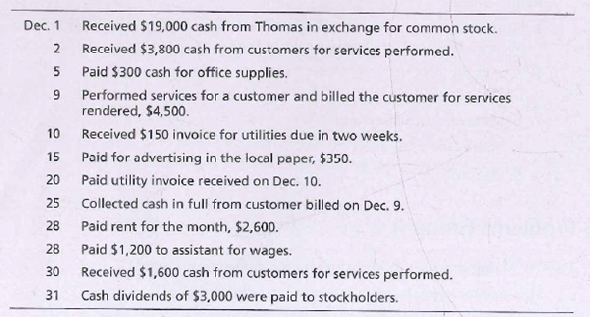

This registration-founded app enables you to sign up for a small loan and you may pay it back so you’re able to make borrowing from the bank. (You also get all the money back in the end.)

To begin with, make an application for a cards Creator account which have Self to get a great borrowing creator loan. Don’t be concerned. There won’t be any difficult pulls on the credit report. After approved, you could look for a repayment amount and financing complete to start and work out payments.