If you’re considering attempting to sell your current family and buying another you should know a link financing

Extremely home owners fundamentally make an effort to close the business and purchase towards an equivalent date. While it musical quick, this is a risky and tiring choice. Very first, it leaves numerous stress on group. You have got to vacate your own old house, stock up the brand new swinging truck and also have get arms of new home and you can move in all-in-one big date. Sometimes, availableloan.net/installment-loans-mo/spokane a different sort of holder have a tendency to started to the new where you can find pick that supplier has not moved out. Some sellers faith he’s got up until midnight to vacate. A lengthy, exhausting, exhausting big date and this can be eliminated. Selling and buying on a single Day = Stress!

A real property closing was a complicated count of a number of events, every one of whom need certainly to work together so as that for each and every transaction happens efficiently. Several transactions inside a cycle out-of closings most of the determined by one other and often dilemmas may arise. The attorney have dilemmas obtaining the expected funds to shut or perhaps the purchaser may have some issues that cannot be fixed you to date. These circumstances could possibly get prevent or delay the brand new closure.

Also in place of this type of potential troubles, wouldn’t it become nice having a short time otherwise months where to do some renovations on the new home specific decorate, cleanup otherwise upgrading before you could move around in?

What exactly is a connection loan and just how can it let?

Link fund is actually short-title financing. They offer brief money in accordance with the security on your existing family. A bridge financing can give you the money with the down fee you need to intimate your purchase in advance of researching the brand new funds from the profit of your house.

Bridge Funds is actually putting on during the dominance especially that have the current number lower rates. He is Canada’s most useful-remaining secret economic tool. Exactly how Connection Capital performs and exactly what it can cost you

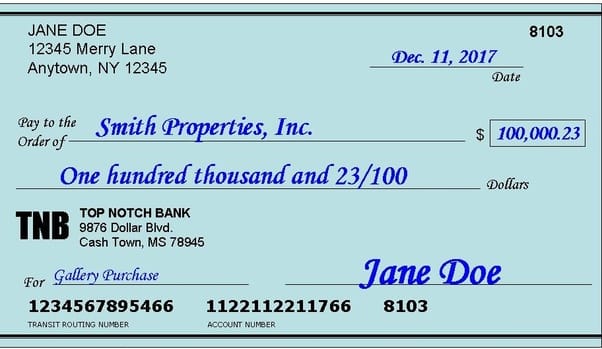

Can you imagine you have just sold your home for $five-hundred,one hundred thousand. This new closure day is actually December 1. You have a preexisting home loan out of $250,100, you have $250,one hundred thousand inside collateral. You purchase some other household to own $700,one hundred thousand. In lieu of a determining a closing day out-of December 1 in order to coincide with your marketing, you intelligently favor November 15th into the pick. This provides you the opportunity to enter the new home and you will prepare yourself they for the move in big date out-of December 1. Maybe you plan to do a little renovations or simply have to spend time transferring.

The lending company approves your to possess an alternative first-mortgage of $525,100 (75% of your price). Thus so you can intimate, need $175,100000 and closing costs (and you will swinging prices and you may you can easily repair costs). Can you imagine we would like to use $225,000. Contemplate, you’ve got collateral out-of $250,one hundred thousand.

This is how the latest Link loan works:

- Connection amount borrowed would-be $225,100000. (That is $twenty-five,100 below this new equity you’ve got on the current family. The bank does not constantly lend your over ninety% of your own collateral in your home however when is it possible you acquire doing ninety% regarding an enthusiastic asset’s worthy of? Usually not.)

- Rate of interest differ but it’s generally to Perfect plus dos.00% (evaluate today’s primary rates here)

- Financial management fees are different but they are usually doing a quarter away from a share point in this case $. (You ount dependent on your own reference to the financial institution.)

- Legal costs are very different based Lender and you may Attorney… $two hundred so you can $400.

- Desire will set you back could well be to $29 on a daily basis. Overall notice would-be approximately $493 having 17 weeks (Late fifteen-Dec step 1).

Full total cost of your own Link Loan could well be anywhere between $1200 and $1400 dependent on your lawyer’s court charge and you can Bank admin charge.

Certification, limitations and you may risks

- Bridge Money usually are merely given by the loan supplier to possess your brand new family. They rating anxiety about the potential for your current family perhaps not closure. There was certain exposure and you can risk toward Lender.

- The attorney will be required to provide a creating to join up home financing in your new house throughout the unrealistic feel one to the fresh sale of your established domestic drops as a consequence of.

- You really need to have joined on the a firm deals in your current where you can find be eligible for a connection Loan.

Because of the additional assurance and you can autonomy provided by which device, someone considering buying and selling would be to give a link loan serious planning.