Wraparound Loan – Financing filled with the remaining balance into a fundamental very first financing

Submit to Readiness (YTM) – The internal price out-of return into the a good investment. Typically takes under consideration the funding output as well as their time.

Area – A geographic area set aside and you may defined of the regional regulation to own particular minimal play with. Areas have been susceptible to certain constraints or conditions.

Annual Commission – The fresh annual percentage to own a credit line is born from the the start of the initial wedding of your own line of credit and you may each year thereafter.

When you look at the identity of your own loan the lender renders payments to the fresh builder due to the fact functions moves on therefore the borrower tends to make notice money toward only the financing that happen to be disbursed on the creator

Attorney-In-Facts – Person who holds an energy from attorneys out of a different sort of to perform records on behalf of the fresh grantor of your own power.

Limit – Describes a supply away from a changeable rates home loan (ARM) that limits how much the rate otherwise payment increases or disappear.

Co-creator – Someone who cues a good promissory note in addition to the number one borrower. A good co-maker’s trademark promises that the financing might possibly be paid off, while the borrower and co-originator are similarly accountable for new fees. Either titled an effective co-signer.

Design Mortgage – A short term loan that is used to invest in the building away from yet another home. Generally speaking, the building loan are refinanced on the a long-term financing after the residence is done.

Credit file – Track of your current and you will past debt installment activities. In regards to our testing aim, the credit declaration percentage is recognized as being an authorized fee.

Draw Several months – Basically with the household guarantee lines of credit, new draw period ‘s the time period as possible access money from the brand new range. Following mark period ends, an installment several months fundamentally comes after.

Escrow Fee – The new percentage of a great borrower’s month-to-month mortgage payment that is held by mortgage maintenance company to pay for assets taxation, chances insurance rates, financial insurance or other affairs while they be due.

Federal Homes Government (FHA) – A region of the You.S. Department away from Construction and you may Urban Creativity (HUD) one assures low-down commission mortgage loans supplied because of the certain loan providers. The loan have to meet with the depending direction away from FHA managed in order to be eligible for the insurance.

Ground-rent – How much cash which is purchased employing belongings when title so you’re able to a home was kept because a rent keep estate as opposed to a charge simple estate.

HUD Median Earnings – Average family money for a particular condition or metropolitan analytical area, because estimated from the Service regarding Houses and you may Metropolitan Advancement (HUD).

Mutual Membership – A card membership held by two or more anyone so that all of the are able to use the brand new membership and all of guess responsibility in order to pay-off.

Mortgage Union – An authored provide from a lender to include resource so you’re able to an excellent debtor. The fresh partnership page claims the fresh new terminology less than that your bank agrees to incorporate investment to the borrower. Also called a commitment letter.

Financial Rules – Steps of the Federal Reserve System so you can influence the price and you can availability of borrowing from the bank, on goals out-of generating monetary gains, full employment, speed balance and you will well-balanced change together with other regions.

Net Settlement costs – For our review aim, the web based settlement costs will be the overall settlement costs quoted of the a lender, quicker any credit otherwise promotion that is given.

Percentage Alter Go out – This new time whenever another monthly payment matter requires affect a varying-speed mortgage (ARM). The fee change day always takes place in the brand new times once this new variations big date.

Private Financial Insurance coverage – Insurance policies provided with an exclusive company to safeguard the loan financial up against losings that might be obtain if financing defaults. The price of the insurance is sometimes paid down by the debtor and that is usually necessary in the event the amount borrowed is more than 80% of residence’s worth. Sometimes referred to as home loan insurance rates.

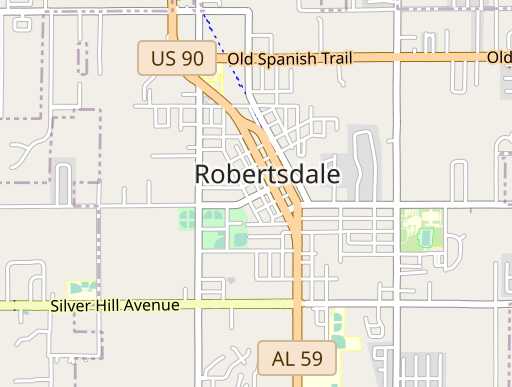

Rate Lock https://www.paydayloanalabama.com/ladonia/ – A binding agreement from the a lender to ensure the interest given to possess home financing provided the loan shuts for the given time.

Best out-of Earliest Refusal – A binding agreement provision that requires a property owner to provide a different sort of party the original possible opportunity to purchase or lease the home before it is open to someone else.

Basic Commission Formula – The method regularly dictate the payment per month expected to pay the remaining dominating balance from a loan into the fairly equal installments, over the left label of your financing within latest appeal rate.

A credit score assists a loan provider to choose whether a borrower have a reputation paying down debts in a timely manner

Alternative party Charges – Third party costs are usually charge your financial tend to gather and pass on towards the person that indeed did this service membership. Such as, an appraiser is paid down the latest assessment fee, a cards agency are paid off the financing report fee and you will good term team or a legal professional is reduced the title insurance premiums.

Treasury Bond – Flexible, long-label U.S. Bodies financial obligation obligation that have a readiness regarding 10 years otherwise prolonged, awarded from inside the lowest denominations out-of $1,000.

Cord Transfer Fee – A charge billed because of the specific loan providers to cover price of wires the borrowed funds fund for the compatible activities, such as the identity providers or attorneys, so they are for sale to closure. In regards to our investigations intentions, a cable tv transfer commission is considered to be a third party fee. But not, specific loan providers may well not costs for this service.