Even a destination-free loan away from a daddy to help you a child might happen income tax accountability with the mother or father

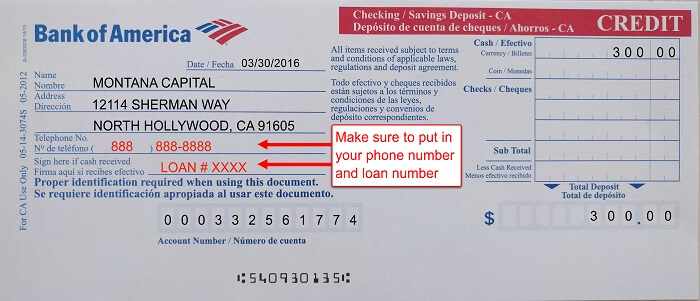

The cash you give since something special to your child means become acquired, monitored, and you will documented. To safeguard your order, fool around with home financing elite.

Before loans Johnson Village you sign a mortgage

Specific loan providers want every functions into the name to go on the mortgage price. Even when the intent is actually for the infant to cope with the new monthly mortgage payments, the parents are financially responsible for your debt. But really, in case your parents are not into mortgage, then they cannot enjoy the financial notice tax deduction.

This new Irs takes on which you earn interest even although you cannot, in fact it is taxable earnings. Parental loans add to the child’s debt burden and may even hurt the newest newborns likelihood of being qualified to possess capital in their right. Into the confident top, an adequately submitted mortgage lets the baby to optimize deductions from the taxation big date.

Even when the moms and dads bring a down-payment, the little one commonly still need to qualify for the borrowed funds, and therefore boasts which have dollars supplies available to you, a steady business, and you will a reliable money.

For those who cosign having home financing, and child non-payments, then your credit history is influenced. You and good cosigner is just as responsible for paying the loan.

Cash Presents

Lenders generally let the down-payment on the a first home are manufactured entirely or partially of money gift suggestions very a lot of time as the almost every other criteria was met. Such as for instance, Freddie Mac’s Family It is possible to home loan, allows the whole step 3% necessary down-payment in the future out-of gift suggestions.

Potential Taxation Coupons

Parents exactly who get a home and enable their child to live inside it could probably take significant income tax write-offs. Assets fees, home loan interest, solutions, fix, and you can architectural advancements are allowable into an additional household.

not, while you are a landlord is deduct as much as $twenty-five,000 from inside the losses annually, parents ily people. If the child pays no-rent, then your state is individual utilization of the property, and you can local rental-relevant write-offs aren’t welcome. Yet not, in the event your child have roommates who pay-rent, then the moms and dad could possibly do the leasing-associated write-offs if you are allowing the infant to live on here rent-totally free.

Income tax Complications

Financial attention deduction might only be used by someone who pays the loan and you will possesses (otherwise together possess) your house. Should your father or mother holds the home label however the youngster renders the borrowed funds commission every month, then neither qualifies toward notice deduction. When your child possesses any part of your house, they can be subtract the newest display of the desire which they in reality shell out.

Note, however, one splitting desire with your child so you’re able to one another claim the loan appeal deduction complicates the income tax filing. Regarding several citizens who happen to be single and as you accountable for the mortgage, extremely common for only the first person on the financing for Internal revenue service Means 1098 regarding the mortgage lender. This new father or mother and child co-citizens have the ability to separated the interest on home loan interest tax deduction, nevertheless separated will likely be predicated on what was indeed reduced by the for every single manager into the year.

One another mother or father and youngster need install an extra report so you can its tax statements explaining new split of the mortgage attract and you will departure as to the are reported on the Internal revenue service on Form 1098. The one who don’t found Function 1098 will also you prefer in order to document the name and address of taxpayer who performed have the full notice advertised inside their name for the Setting 1098.

Reveal percentage list does not need to accompany the fresh taxation come back, but you need to keep all the details for many years but if out-of a review.