How lowest usually family equity mortgage rates drop from inside the November?

Higher rising prices as well as the increased interest levels meant to tame they possess dogged borrowers over the past few years. Even after highest borrowing costs remaining the majority of people out of incorporating the latest financial obligation, family equity credit have stayed a selection for those people trying utilize its home’s worth. Because these house guarantee loans and home collateral personal lines of credit (HELOCs) is actually backed by your house, they often come with straight down rates of interest than handmade cards and you may other sorts of loans.

Fortunately, the lending ecosystem is changing on the ideal. Rising cost of living was shedding, plus the Federal Reserve cut rates from the 0.50% when you look at the September. Toward Given fulfilling recently and you can once more for the December, certain economists allowed next interest rate reductions, which can make borrowing inexpensive.

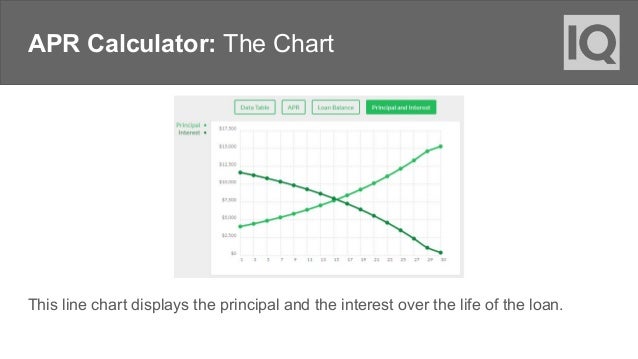

If you are latest developments look promising, you’ll find nothing particular. Interest rates across the some mortgage systems, also mortgage loans, edged highest in , new national mediocre rates for household guarantee money and you can HELOCs was 8.41% and you can 8.70%, correspondingly. But could occurrences in November force family collateral mortgage cost straight down, and if thus, by how much? Let us break apart exactly what can happen and how it could affect your.

A little house security mortgage rate lose is possible within the November

In the event the Fed lowers the latest government money rate since the certain desired, a corresponding lose during the mortgage rates – as well as family equity financing and you may HELOC prices-might be you can. The fresh CME Group’s FedWatch Unit means a good 98% possibility the lending company will cut the rate on their November conference. If it happen, one another the newest and you can established HELOC costs you will fall off, because they’re varying and you can to alter every month.

By contrast, family collateral loan costs may not find a primary feeling out-of an effective Provided price slash, because they are usually repaired and don’t to switch monthly for example HELOC pricing.

“In the event your Fed falls the rates by one fourth part, you might pick HELOC pricing drop by one fourth,” says Mason Whitehead, part manager in the Churchill Mortgage. “I don’t consider anybody try pregnant an alternative 50-basis-area rates cut, and there’s specific talk about maybe not watching a cut right out in the all.”

Jeremy Schachter, department movie director from the Fairway Independent Home loan Business, shares an equivalent outlook however, factors to bad credit installment loans Maryland December just as one flipping area.

“I do not anticipate the brand new Federal Set-aside to decrease costs within their next conference to have during the mid-December. Based just what monetary news arrives, the latest Feds could possibly get lose costs after that,” Schachter states.

Domestic security loan cost browsing are nevertheless regular in November

If you find yourself thinking about tapping into your home equity for cash, you could find somewhat lower rates when you look at the November. Remember one to certain pros expect pricing to keep an equivalent otherwise just dip a while in the short term.

“We predict home guarantee lending rates to keep an identical within the November,” states Schachter. “The Government Set-aside performed a primary decrease of 0.50% during the Sep. Since then other economic research has come aside appearing your employment market has been quite strong.”

Schachter believes the latest recommendations from mortgage prices, along with family security lending options , get rely partly into next November perform statement from the the brand new You.S. Agency from Labor Statistics.

“HELOC cost are usually linked with primary, so they really is actually inspired in the event that Provided reduces or enhances the federal funds price. I do believe this type of pricing will remain flat, however, if the Provided reduces the speed in the November, you could discover a little shed inside the HELOC rates-very little to get thinking about, but all bit support,” Whitehead claims.

The bottom line

When you find yourself a beneficial 0.25% price miss inside the November could save you currency, contemplate – it’s not protected. And you may depending on the amount you acquire, the possibility offers might not be large. And no cure for expect with 100% certainty in the event that cost goes up, off, or stand regular, work at what you could handle. Whenever you are comfortable with the brand new costs and also the financing fits your economic needs, progressing could make experience.

“A home guarantee mortgage does not need to be an easy decision, but instead one that fits into your long-title financial goals,” says Alex Beene, a monetary literacy teacher toward College or university off Tennessee within Martin. “When you find yourself utilizing it modestly and also to create really worth into the lifetime either to own an investment in the your self or something you want to market regarding the brief or longterm, this may be are a smart decision. If you don’t have one bundle detail by detail, it’s a threat never simply take.”

Luckily for us, interest rates can be trending down-a pleasant signal to own individuals prepared into the sidelines until nowments regarding the Government Reserve’s September conference recommend next speed slices you’ll be on the way this year and you may towards 2025, making home collateral credit alternatives possibly economical in the near future.