Do you know the Main Bank’s home loan financing guidelines?

1. Loan-to-income restrict

Brand new Central Bank’s legislation limit the restrict matter some one can acquire. This really is four times their disgusting annual income if you’re a good first-time consumer and 3.5 times your own terrible annual income when you find yourself a second-time or further customer.

Thus let’s say, such, that you will be into an income out-of 50,000 annually. It means you’re greet acquire a total of two hundred,000 under the Main Bank’s regulations while you are a first-date consumer. If you find yourself to shop for having somebody exactly who along with produces 50,000, you to number doubles so you can 400,000.

2. Loan-to-worth proportion

The next mortgage credit rule identifies the borrowed funds-to-really worth proportion one loan providers are required to observe. So it refers to the percentage of the property’s worthy of you can obtain and exactly how most of they you need to pay money for initial in the way of in initial deposit.

First-go out people and you will second-big date otherwise subsequent consumers are allowed a max loan-to-value of ninety%, meaning you’re required to has a deposit of at least 10% for all the property.

cash advance usa loans in Downieville Lawson Dumont CO

What if, including, your a first-time consumer and also you want it property having three hundred,000. This new code mode you’ll need at least put of 31,000 one which just use the remaining 270,000.

Conditions into laws and regulations

In just about any one to season, 15% of mortgages you to definitely lenders share with you so you’re able to sometimes first-go out otherwise second-some time after that consumers can also be violation money limit otherwise deposit requirement. There are also referred to as ‘exemptions’.

How to score home financing exception to this rule?

Firstly you must know that you could constantly only score an exemption not as much as One of several financing statutes. It is really uncommon you to a lender assists you to violation both the financing-to-earnings limit and also the financing-to-worth proportion. Its just one or even the almost every other.

If you earn a different will depend on your credit worthiness, the quality of their mortgage software and you can if the bank nevertheless has actually space giving aside an exception to this rule.

Exemptions are all the burnt of the center of one’s calendar year, when you should sign up for you to, the earlier in that you use to suit your financial the greater.

Banks and often promote exemptions to those towards the highest income, and thus up to fifty,000 or significantly more than to possess one applicant and 75,000 and you may above to have a shared application.

A limit, maybe not a guarantee

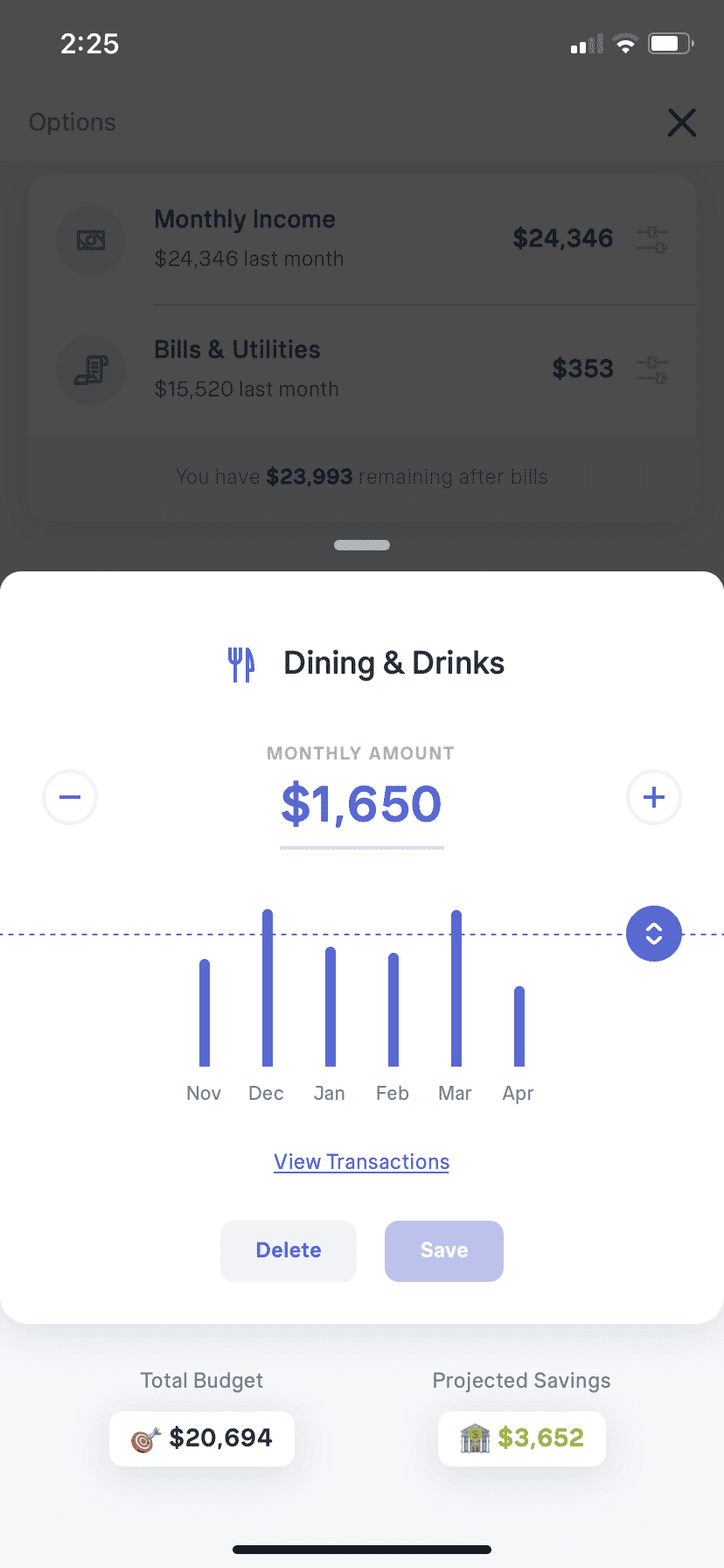

It is critical to remember that the newest Main Bank’s lending laws and regulations merely refer to the maximum amount you’ll be borrowed.

Financial institutions usually takes into consideration your other funds, outgoings, bills and you can commitments before making a decision simply how much they are going to provide your.

Carry out the Main Bank’s mortgage credit laws and regulations connect with switchers?

If you are thinking about altering your own financial then Central Bank’s rules cannot pertain. Although not extremely finance companies won’t allow you to button if you are for the negative guarantee and more than will demand one has at the least 10% guarantee of your house.

Perform various countries have these laws?

A number of other european countries have regulations and that dictate exactly how much you might be allowed borrow having a mortgage and exactly how most of a beneficial deposit need. And in some cases the rules is also stricter than simply ours.

Exactly what now?

To avoid to be bamboozled throughout the meetings with your bank or large financial company, it is advisable in order to familiarise yourself with some of the mortgage-related buzzwords you likely will look for on your financial excursion.

- Read through this self-help guide to understand the various style of mortgage rates of interest .

- If you are a first-day homebuyer you can claim an income tax promotion of up to 31,000 for the Assist-to-Purchase strategy , which is made to assist very first-time customers obtain the deposit wanted to buy a newly built household.

- Fixed financial rates of interest have become ever more popular, however it is critical to comprehend the advantages and disadvantages out of both variable and you may fixed costs .

- While you are thinking about to buy an electrical energy-effective house or apartment with a building Opportunity Rating (BER) of at least B3 or even more, you could apply for a green financial. You can discover more and more eco-friendly mortgage loans in this book .

You might stay high tech towards the newest home loan reports and you will advice with our posts and courses pages.

Get your financial towards the

After you’ve get acquainted with the new Central Bank’s financial lending legislation and you may home loan terminology, you can done the mortgage travels into the .

Head over to all of our financial calculator and simply find the best rates, offers and cashback incentives out-of every one of Ireland’s mortgage brokers .

When you decide it’s time to make an application for home financing, you could agenda a beneficial callback because of our totally free large financial company service plus one in our experienced monetary advisers will call that get app become. They’ll be here every step of your ways throughout your mortgage trip – no extra cost to you as the a customers!

The mortgage broker provider is totally digital constantly, meaning everything you can be achieved on the internet straight from your home.

Ultimately, you will you desire home loan cover insurance coverage and you will homeowners insurance locate financial approval, both of which we could and help with!