Bookkeeping Basics for Small Business Owners: Everything You Need to Start Doing Your Own Bookkeeping

Friday, March 26th, 2021If you’re searching for accounting software that’s user-friendly, full of smart features, and scales with your business, Quickbooks is a great option. Consider using one of the best bookkeeping services to make managing your books a breeze. Diamonds may be forever, but the ink on your expense receipts is not.

Precision Bookkeeping: Records, Reconciliation, Reporting

- Expenses are all the money that is spent to run the company that is not specifically related to a product or service sold.

- Only an accountant licensed to do so can prepare certified financial statements for lenders, buyers and investors.

- You may also be expected to take on more advisory and analytical roles as bookkeeping becomes more automated.

- The process involves sending estimates and invoices and keeping track of due dates.

- You can learn bookkeeping for free and at a low cost through online courses.

- Larger businesses adopt more sophisticated software to keep track of their accounting journals.

In order to know what you earned, you have to know what your business earned first. Now, how you use your bookkeeping to grow your business is the game-changer. So to prevent this, in this post we’re going to explain http://www.gants-region.info/news/klubniku_ljudi_sobirajut_radi_mashin_i_dach_a_my_cherniku_radi_vyzhivanija_reportazh_iz_chernichnogo_kraja/2013-07-15-875 for small businesses.

Skills you’ll gain

You typically maintain accurate accounting records across all transactions while communicating with others. A bookkeeper’s job comprises maintaining and balancing financial records, including transactions from coworkers. Effective communication is essential for recording those daily transactions.

How to Budget for Bookkeeping Services

When you’re stuck in the minutiae of reconciling your transactions, this won’t feel like “seven easy steps”. If any of this sounds a bit overwhelming, you may want to consider engaging an experienced bookkeeper or accountant to help you tackle this process. And don’t worry, the bulk of work has already been done once all of your transactions are classified and reconciled. The cash flow statement shows the movement of cash related to financing activities, investing activities, and operating activities. The best part is that most of these programs enable you to connect your business bank account.

- Most companies use computer software to keep track of their accounting journal with their bookkeeping entries.

- Good Bookkeeping SoftwareDetails of different software options – paid and free – to help you select the one that suits you best.

- These accounts and their sub-accounts make up the company’s chart of accounts.

- For full-time bookkeepers, the average annual salary sits around $77,000, according to Glassdoor.

Use accounting software if:

This method is straightforward and suitable for smaller businesses that don’t have significant inventory or equipment involved in their finances. It doesn’t track the value of your business’s assets and liabilities as well as double-entry accounting does, though. Bookkeeping is the process of recording all financial https://webmascon.com/topics/coding/42a.asp transactions made by a business. Bookkeepers are responsible for recording, classifying, and organizing every financial transaction that is made through the course of business operations. The accounting process uses the books kept by the bookkeeper to prepare the end-of-the-year accounting statements and accounts.

You need it to do your taxes

Similarly, if you pay for office supplies in February, you record the expense in February, regardless of when you actually used the supplies. The next step is to decide between single-entry and double-entry bookkeeping systems. Outsourcing your bookkeeping is another option, and this guide on how to find the best virtual bookkeeping service can help you get the process started. Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. The chart of accounts lists every account the business needs and should have.

Best Accounting Software for Small Businesses of 2024

To keep your financial records, you’ll need a chart of accounts—a complete listing of every account in your accounting system. These accounts are used to categorize all of your business’s transactions and are crucial for maintaining organized financial records. Accounting software eliminates a good deal of manual data entry, making it entirely possible to do your own bookkeeping. However, it can be difficult to catch up if you fall behind on reconciling transactions or tracking unpaid invoices.

And sometimes it can be produced to include comparisons against the prior year’s same period or the prior year’s year-to-period data. For both sales and purchases, it’s vital to have detailed, complete records of all transactions. You’ll need to note the amount, the date, and any other important details to ensure you can accurately summarize your finances when it comes time for tax season. Purchase receipts should always be kept as proof that the purchases took place. Professional bookkeepers and accounting professionals are available to manage, track, and report on financial activities.

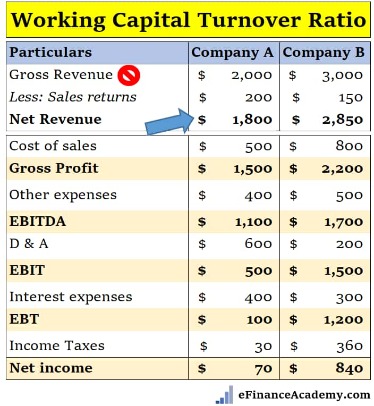

The entry system you choose impacts how you manage your finances and how your bookkeeping processes will work. Revenue is all the income a business receives in selling its products https://egypt-hrg.ru/sobytiya-strany/1377-prezident-egipta-pozdravil-jemmanujelja-makrona-s-izbraniem-na-vtoroj-srok.html or services. Costs, also known as the cost of goods sold, are all the money a business spends to buy or manufacture the goods or services it sells to its customers.

This information can help you make informed decisions about your business operations, investment opportunities, and other financial decisions. In addition to helping the business owner, bookkeeping gives banks, investors, and the government the ability to ascertain the financial health and potential of the business. Double-entry accounting enters every transaction twice as both a debit and a credit. Your business’s books are balanced when all of the debits equal (or cancel out) all of the credits. And since it takes equity, assets and liabilities — on top of expenses and income — into account, it typically gives you a more accurate financial snapshot of your business. Once you’ve figured out your ideal accounting method, start by creating a balance sheet, which you will use to record and track equity, liabilities, and assets.

Regardless of your small business’s complexity, bookkeeping will still take time out of your week, so be sure you have the resources before committing to handling it yourself. Some accounting software products automate bookkeeping tasks, like transaction categorization, but it’s still important to understand what’s happening behind the scenes. It all begins with getting your accounting software set up correctly.