Loan officials can often suggest promoting agents in your neighborhood; ask your administrator in the real estate professional suggestions when sharing the loan

Monday, January 13th, 2025- Turn light changes on and off.

- Discover and you can personal windows and doors to be certain they work securely.

- Remark prior household bill expenses.

- Check out the possessions tax bill.

Discover A realtor

During the a house marketing, both the buyer and you may vendor are usually depicted by the an agent. Attempting to sell representative: Representative into the consumer (you). Often referred to as a client’s agent. List representative: Broker on the seller. Referred to as a good seller’s representative.

Whenever a house is sold, the vendor usually pays a house fee in order to both the checklist representative and the selling agent. It is extremely very theraputic for the consumer to utilize her real estate professional.

An excellent real estate agent will know your regional industry and will help you can see an ideal in home on your own budget, place and you can wanted has actually. Throughout your browse, just remember that , might probably need give up on the specific activities, so it is important to select your own critical means rather than the desires.

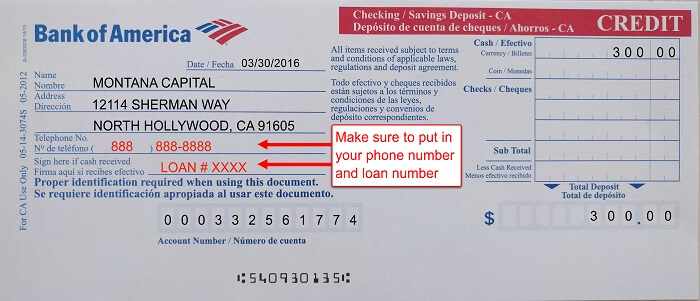

Meet with Your Lender

With your borrowing and you can budget information installed and operating, you are https://paydayloanalabama.com/edgewater/ really-happy to speak to a loan officer to examine the loan options and have now an effective pre-certification page.

Brand new pre-degree letter is roofed having any offer make toward an excellent house to share with owner which you have met with an effective mortgage lender and you are clearly ready to create a deal. (more…)