Financial carnage: Very first Republic with the brink off personal bankruptcy

Wednesday, January 1st, 2025Adopting the bankruptcy off Silicon Area Bank (SVB), and therefore http://paydayloanalabama.com/castleberry authored shockwaves from the financial world, several institutions started initially to feel the ramifications of which collapse. It is especially the situation for Basic Republic bank. Its dealing with a time period of drama and receiving closer into the edge of this new precipice everyday. ‘s the financial carnage merely beginning in The usa?

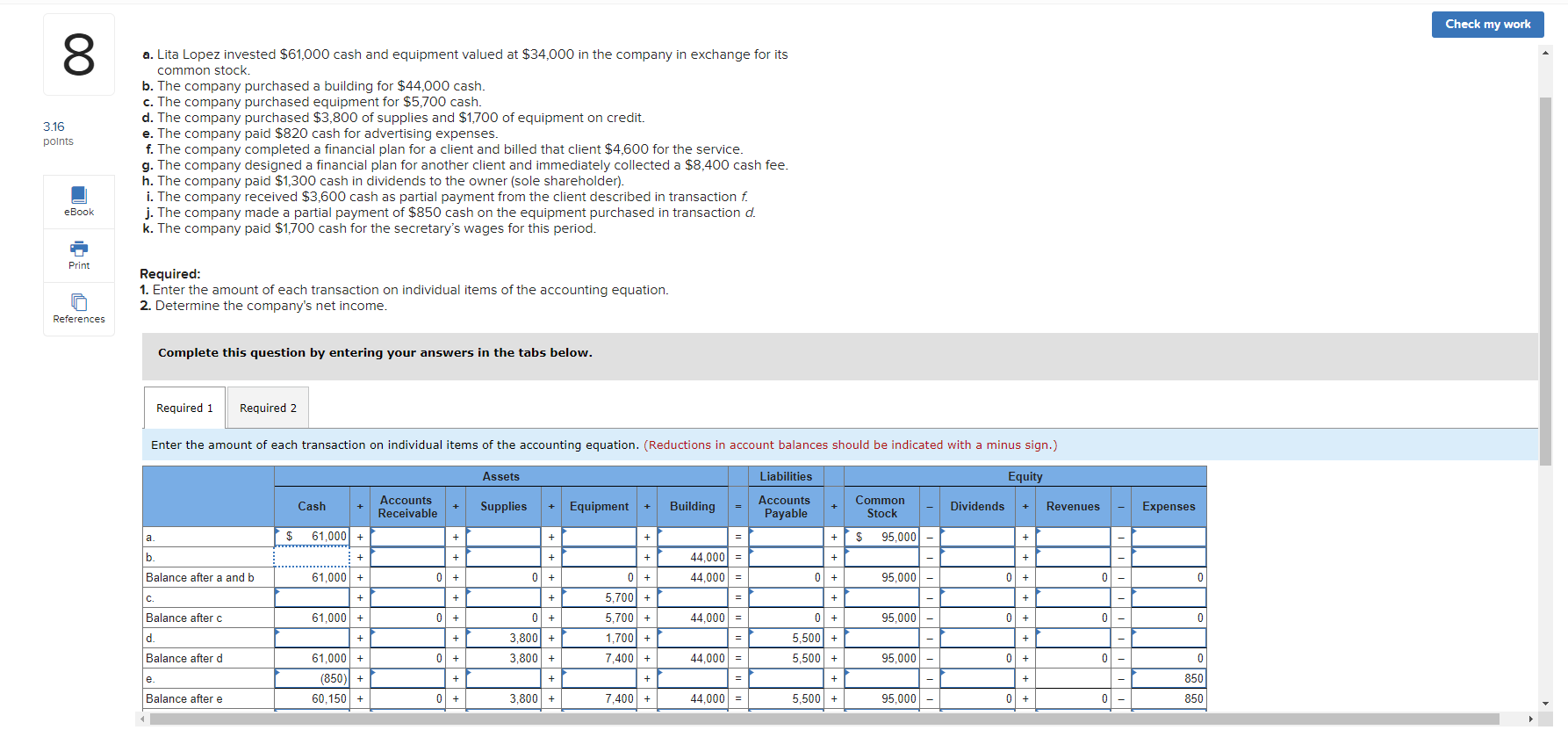

Earliest Republic facing deposit journey

To have 7 months today, Earliest Republic could have been unable to avoid a big journey away from the deposits. FDIC uninsured dumps (the federal government looks guilty of compensating depositors in the event of bankruptcy). Symbolizing nearly 75% of your bank’s overall dumps, have started so you’re able to evaporate due to the fact SVB personal bankruptcy.

That it flight is foreseeable. While the particular finance companies shall be conserved, along with their critical proportions (too-big to help you falter banks), while some might not be, depositors enjoys the need for withdrawing their money as quickly as you’ll be able to to guard them.

Up against this case, the initial Republic Titanic was required to grab drastic measures. The organization lent massive amounts from JP Morgan together with Government Reserve. (more…)